How Much Money Do You Need To Move Out Of Your Parents House

Living with your parents has its perks: homecooked meals, childhood memories… oh, and free rent. So it's not surprising that nearly half of 22-to-24-year-olds and just over one-fourth of 25-to-29-year-olds in the U.S. lived with their parents in 2019, according to the Federal Reserve Board. The top reason for doing so? Saving money.1

Your childhood home can also provide a safe haven when times get tough. During the coronavirus pandemic, for example, 52 percent of young adults ages 18 to 29 lived with one or both of their parents, according to Pew Research Center.2

At some point, though, you might feel the urge to get your own place. (And your parents probably wouldn't mind, either.)

As you prepare to live on your own, you might want to explore the statistics behind financial independence and see the average costs of living expenses across the country. Financial expert Lindsay Dell Cook is also here to help fill in the gaps as you determine how much money you need to move out. She's the president and founder of Budget Babble, which provides personal financial education and coaching services.

How much should you save before moving out?

Even if you think you know how to live on your own, you're probably still wondering: How much money do you need to move out?

Everyone will have a unique answer, says Cook, because the cost of rent, your lifestyle and other factors can vary drastically from person to person. While the exact numbers will be specific to the individual, there is a way to figure out how to live on your own while remaining financially secure.

The key, according to Cook, is to estimate everything from your moving costs (hint: check out tips for moving on a budget) to the monthly expenses you'll have once you're living on your own. You'll also want to keep your long-term savings goals in mind.

Below, Cook walks through each of the major expenses that you need to account for in your moving-out budget before you actually make the move.

Each category is accompanied by cost averages that can serve as a starting point as you determine how much money you need to move out. You'll find costs by age range since these expenses tend to increase as you get older.

You can explore all of the costs you'll need to plan for, or you can skip to any of the following living expenses to learn more:

- Rent

- Moving

- Utilities

- Home decor

- Food and dining

- Discretionary spending

- Healthcare

- Emergency fund

- Student loans and other financial goals

Open up a spreadsheet, reference your favorite budgeting app or grab pen and paper, and let's get started building your budget for your big move. By factoring in the categories below, you should be able to create your moving-out budget and determine how much you can afford in rent.

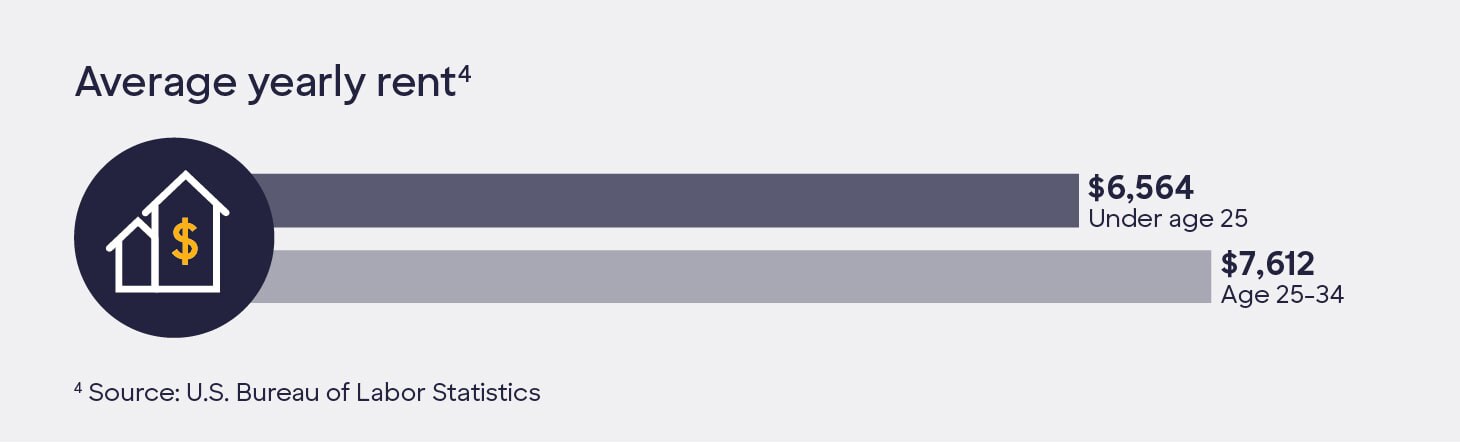

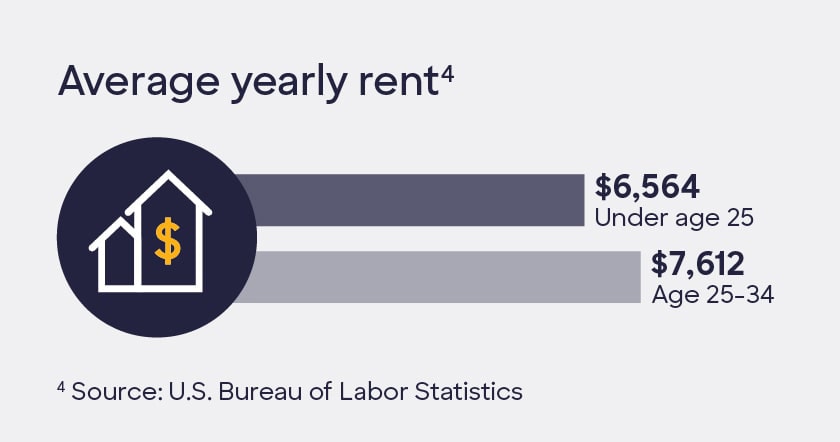

Rent and move-in fees: Account for these basic housing expenses

As you're thinking about how much money you need to move out, your biggest expense will almost certainly be rent. Rents can vary from a few hundred dollars to thousands a month, depending on where you choose to live and if you have roommates to keep costs down. (Word to the wise: If you're living with others, be sure you know how to split living costs with your roommates first.)

While rent is the first thing you might think about before moving out, Cook actually recommends saving it for last as you create your moving-out budget. That's because the amount you can afford in rent will depend on what money you have left after subtracting all of your living expenses in the categories below from your after-tax income.

Remember: Once you sign a lease, you're responsible for that monthly rent payment until the lease expires. It's important to ensure that your budget can accommodate the rent payment.

Keep in mind that simply multiplying your monthly rent by the number of months on your lease won't give you the complete picture of how much money you need to move out. You'll need to account for a potential security deposit, move-in fees and pet fees to be fully prepared.

Security deposits and move-in fees

Cook recommends earmarking one and a half month's rent for your security deposit and/or move-in fees if you don't yet know where you'll live. If you pay a security deposit, you'll likely get it back after your lease is up (provided you didn't do any major damage to the place).

Sometimes, landlords ask for a move-in fee instead of (or, less commonly, in addition to) a security deposit. A move-in fee can cost several hundred dollars, and it's a one-time, nonrefundable expense, Cook notes.

Pet deposits

If you have a pet, keep in mind that many landlords will ask for a pet deposit as well, which Cook has seen as high as $500. "The pet deposit can actually be more significant than you would even imagine," she says.

You may be able to negotiate a pet deposit with your landlord, which could help reduce costs in your moving-out budget.

Moving: Consider all the necessities for the big move

Cook says clients tend to underestimate how much it costs to move out of their parents' place and into their new digs. A 14-foot truck rental (typically large enough for up to two bedrooms) tends to cost between $20 and $30 per day, in addition to a per-mile charge of 68 cents-$1.10, according to CostHelper.com.

For packing supplies, the consumer-focused site estimates the cost of a moving kit for a one-bedroom apartment (comprising 14-29 packing boxes, one roll of 55-yard moving tape and a marker) to usually fall somewhere between $69 and $90.

If you're hiring professional movers, Cook suggests reaching out well before you're ready to pack your boxes. "Just because you're not ready to move doesn't mean that you can't reach out and just get a pulse on how much things might cost." A moving-out budget that includes all the costs associated with your move can take the guesswork out of how much you'll need to save.

Cook warns that a moving truck, packing materials and professional movers can add up. "Whatever you think it will be, add at least $200 to that," she says.

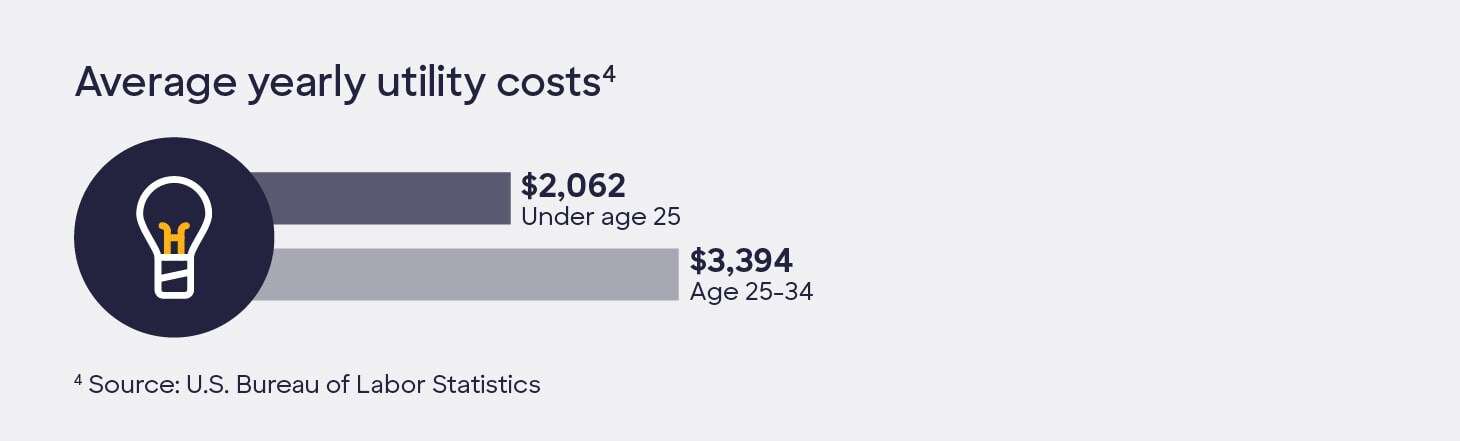

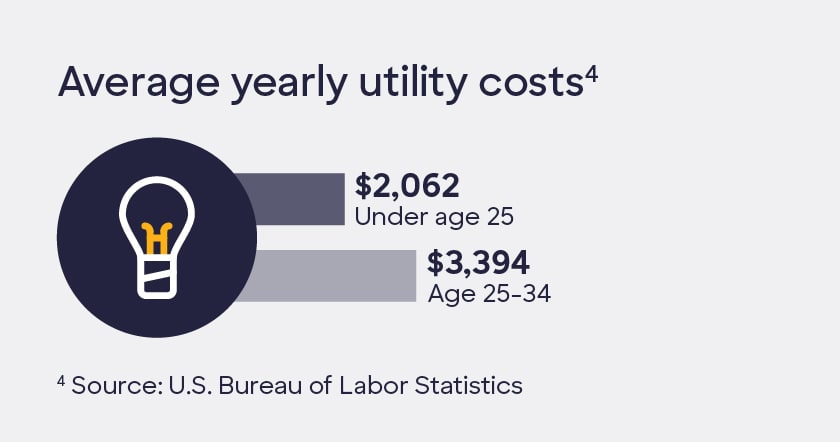

Utilities: Keep the lights on and the water running

Gas, electricity, water—what would we do without them? You'll need to make sure you have enough money earmarked in your moving-out budget to cover your bills to avoid any unpleasant surprises (like a cold shower).

When you're touring new places to live, Cook recommends asking the landlord or current tenants about average monthly utility costs. Make sure you understand which—if any—utilities are included in your rent. Sometimes, Cook says, you can negotiate for your landlord to cover utilities if they're really in need of tenants.

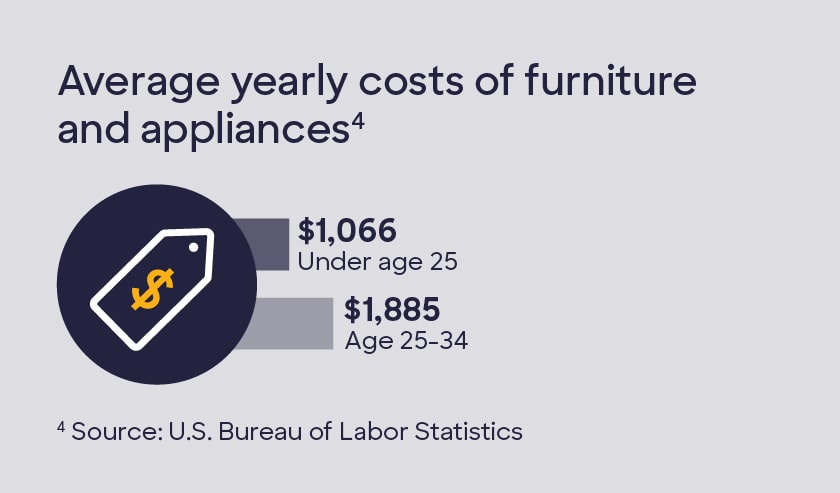

Home decor: Find a balance between old and new

When Cook's clients move into their first places, they sometimes repurpose old furniture from their parents' house or from other relatives. "There's no shame in the hand-me-down game," Cook says.

Some items might seem obvious in your moving-out budget, like a desk if you're planning a home office, but it's the little things that often get forgotten until you need them, like silverware, trash cans and bathmats. That can add up to big, unplanned-for expenses.

Cook encourages her clients to use all the secondhand items they can and then list every new household item they'll need to furnish their apartment. Once they add up the expected costs, Cook increases the estimate by 10%. That's because there are almost always extra little touches or necessities you'll buy to make your new place your own.

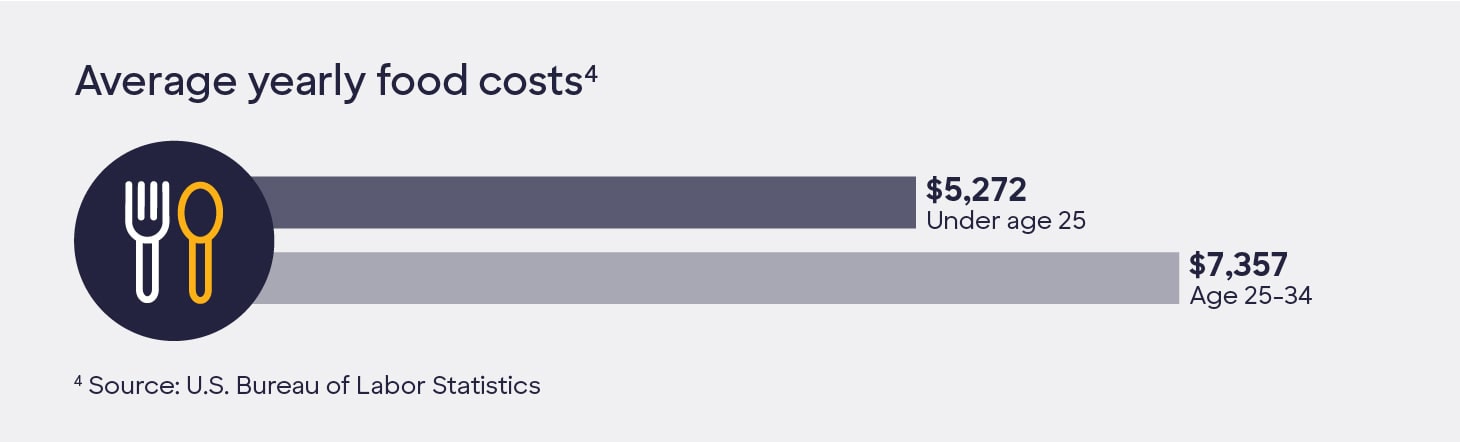

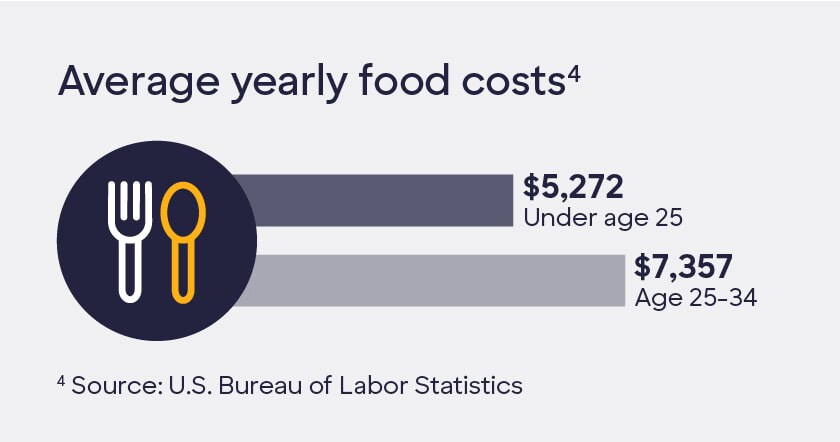

Food and dining: Track your spending for a realistic estimate

Moving out of your parents' house and learning how to live on your own comes with a lot of benefits, but one of the downsides is that you're on the hook for all your meals. Cook says younger adults tend to drastically underestimate how much they'll spend on food. "Some people spend the same amount on food as they do on rent," she says.

The most straightforward way to determine how much you will spend on food is to track how much you are spending on food for at least a week. (If your parents treat you to a meal, ask them how much it cost so you can account for it.) When Cook works with clients to track their spending for the first time, food is the line item that raises the most eyebrows. "They'll say, 'Oh my gosh, I had no idea the line item for food would be so expensive,'" she says.

Cooking meals at home can be an effective way to keep a lid on food expenses, but that takes some experience in the kitchen as you learn how to live on your own—a life skill that can take time to develop. If you want to sharpen your skills as an at-home chef, you can start watching online cooking tutorials and making meals at home while you're still living with your parents.

Discretionary spending: Make room for "the fun stuff"

Unless you're getting help from your parents (and there's no shame in that), you'll be on the hook for every purchase once you move out.

Managing your discretionary spending is a key component of mastering how to live on your own. You can think of your discretionary expenses as wants, rather than needs—and everyone needs a chunk of money available to cover things like a new TV, movie tickets or home gym equipment. How much you have in your discretionary budget each month will depend on your income and your other costs, Cook says.

Some discretionary expenses don't occur on a consistent schedule. You can, however, plan for these costs in your moving-out budget.

Cook encourages clients to look at a calendar and note the weddings, vacations and holiday spending that will need to be paid for over the next year. Add up the estimated cost for each of these big, irregular expenses and divide by 12.

Each month, you can contribute a planned amount to a high-yield savings account that's dedicated to these discretionary expenses. Whenever you need to book flights, buy gifts or update your wardrobe, you'll have a savings account that you can dip into guilt-free. This strategy can help prevent you from stressing over money, too.

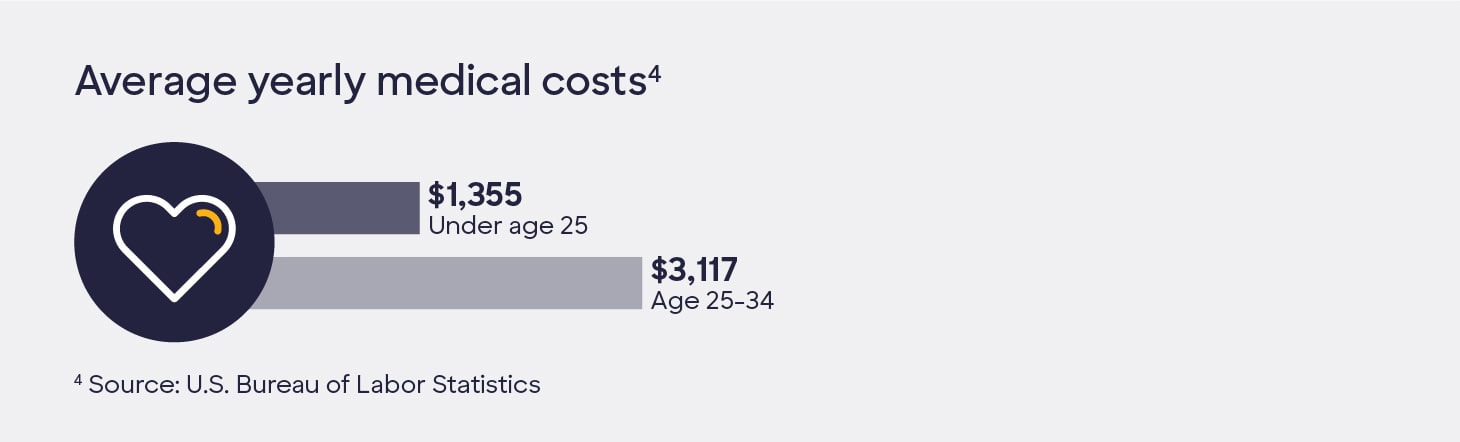

Healthcare: Prepare for expected medical costs

If you're wondering how to live on your own but don't have health insurance, Cook strongly recommends that you get it. You can get health insurance through your employer, your parents or in the healthcare marketplace.

"Medical expenses are one of the main reasons a person can end up in financial distress and debt," Cook says. "Even if you're young and healthy, it's not a gamble worth taking."

When you have health insurance, you might still pay out of pocket for certain visits, procedures and medication. Refer to your insurance plan to see what out-of-pocket costs you'll need to pay and build those into your moving-out budget.

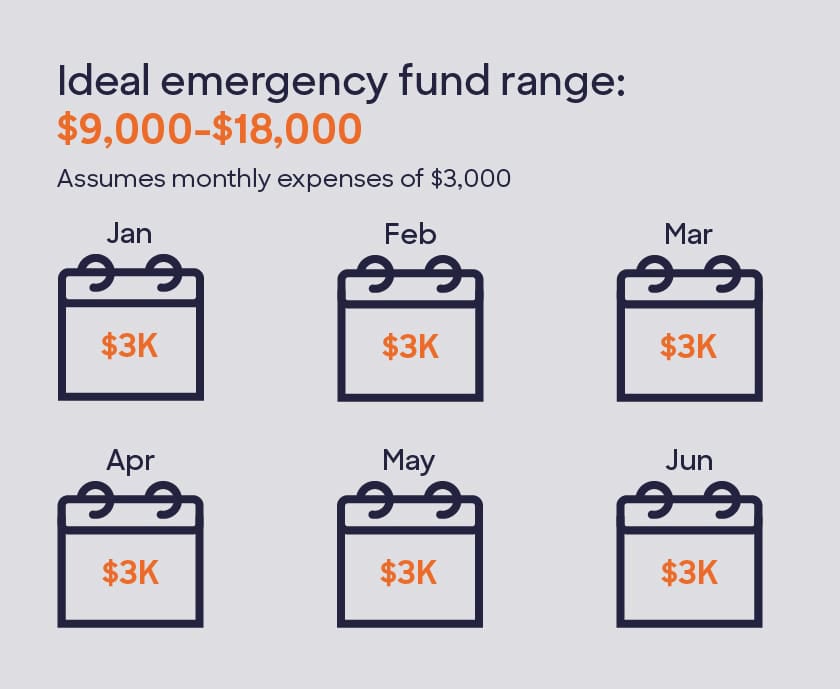

Emergency fund: Start building your safety net

An emergency fund is exactly what it sounds like: money that is stowed away in case you lose your job or unexpected expenses pop up. Experts agree that ideally, your emergency fund should be able to cover your living expenses for three to six months, should you ever find yourself without a steady source of income. "That would include rent, food and any other bills you have to pay, like a car payment," Cook says.

Since an emergency fund is an important and potentially significant part of your moving-out budget, you may want to start saving for this line item well in advance.

However, don't be discouraged if you emergency fund isn't quite where you want it to be. If you're ready to move out before you've built up your emergency fund, you can start small and continue to contribute to it once you live on your own. Just make sure you're budgeting for it like any other expense.

Wondering where to keep your emergency fund? Consider opening a high-yield savings account to stash the cash. This will keep it slightly out of sight, so you won't be as tempted to dip into it for nonemergency use. Plus, the higher interest rate will help your money grow through the magic of compound interest.

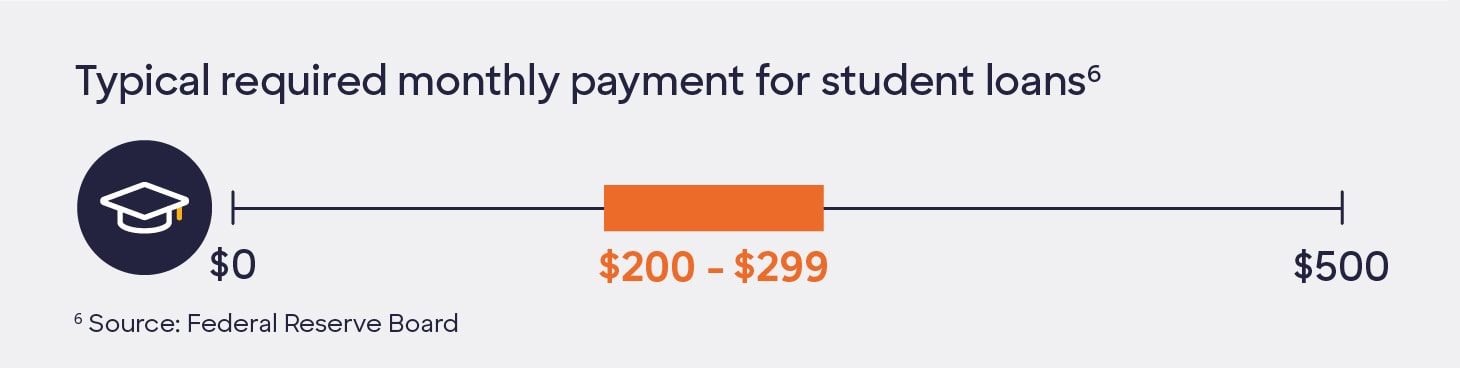

Student loans and other financial goals: Pay off debt and save for the future

In addition to an emergency fund, you want to account for other savings goals in your moving-out budget, Cook says. Whether you want to pay off your student loans, save for a vacation, plan for retirement or financially prepare for grad school, you need to be diligently putting that money away.

"You really want to make sure you understand your budget and ensure that your rent and other living costs are still allowing you to save," Cook says.

Create your own moving-out budget

So how much money do you need to move out? Break out your calculator and add up your honest estimates of each of the above expenses to build your moving-out budget.

After doing the math, will you have enough money left over to save for your goals? If not, then Cook recommends revisiting your financial plan before moving out. "The bottom line is that you either need to be able to cut expenses, have a higher income or some combination of the two," Cook says.

Don't end your budgeting goals there. As you set out on your own, learn how to manage your first salary so you can cover your post-move expenses while saving for the future.

Articles may contain information from third-parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third-party or information.

1 "Report on the Economic Well-Being of U.S. Households in 2019, Featuring Supplemental Data from April 2020." Federal Reserve Board. https://www.federalreserve.gov/publications/files/2019-report-economic-well-being-us-households-202005.pdf

2 "A Majority of Young Adults in the U.S. Live With Their Parents for the First Time Since the Great Depression." Pew Research Center, Washington, D.C. (September 4, 2020) https://www.pewresearch.org/fact-tank/2020/09/04/a-majority-of-young-adults-in-the-u-s-live-with-their-parents-for-the-first-time-since-the-great-depression/

3 "Majority of Americans Say Parents Are Doing Too Much for Their Young Adult Children." Pew Research Center, Washington, D.C. (October 23, 2019) https://www.pewsocialtrends.org/2019/10/23/majority-of-americans-say-parents-are-doing-too-much-for-their-young-adult-children/

4 "Consumer Expenditure Survey, 2018-2019." U.S. Bureau of Labor Statistics."

- https://www.bls.gov/cex/2019/CrossTabs/agebyinc/xunder25.PDF (under 25)

- https://www.bls.gov/cex/2019/CrossTabs/agebyinc/x25to34.PDF (25-34)

5 "True Cost Guide." HomeAdvisor. https://www.homeadvisor.com/cost/storage-and-organization/hire-a-moving-service/#size

6 "Report on the Economic Well-Being of U.S. Households in 2019 – May 2020." Federal Reserve Board. https://www.federalreserve.gov/publications/2020-economic-well-being-of-us-households-in-2019-student-loans-other-education-debt.htm

How Much Money Do You Need To Move Out Of Your Parents House

Source: https://www.discover.com/online-banking/banking-topics/how-much-money-do-you-need-to-move-out/

Posted by: abbotthappold.blogspot.com

0 Response to "How Much Money Do You Need To Move Out Of Your Parents House"

Post a Comment